Building an MVP and Getting Funded in 2025: A Quick Guide

Turning an idea into a successful, funded startup is challenging. A key step in this process is creating a Minimum Viable Product (MVP). An MVP lets you test your idea with real users, get feedback, and attract investors without spending a lot upfront. In 2025, building an MVP and getting funding will involve new trends and best practices. This blog will guide you through these stages easily.

MVP stands for minimum viable product. Frank Robinson first used this term in 2001, and Steve Blank and Eric Ries later popularized it. An MVP is a basic version of a product that businesses release to early users. The main goal of an MVP is to get honest feedback from users to find out what needs improvement without spending a lot of money.

Building an MVP involves a detailed plan and systematic stages to produce a basic product with essential features. This facilitates user input collection and concept validation. Here’s a step-by-step guide on creating an MVP that will grab investors’ interest:

The first step in MVP development is to conduct market research. This helps you understand the changing needs of your target market and what they want in a product or service. Many platforms offer paid surveys to help you reach the right people for your MVP. Understanding your market is crucial to ensuring that your product meets a genuine need and stands out in a competitive landscape.

Identify your target market and user persona. Determine the basic details about your target users by asking:

List the key features of your product or service. Focus on the features that matter most to your target market. Remember, with MVPs, less is more. Prioritize features that provide the most value to your users and differentiate your product from competitors.

Develop and release your MVP. Consider collaborating with an MVP development company to create a user-friendly product. Market your MVP and gather user feedback to make improvements. Building an MVP doesn’t mean it has to be perfect. It’s about learning from real users and iterating quickly.

Analyze customer feedback to identify what is and isn’t working. Use this data to improve your product and ultimately deliver a more complete version to your users. Feedback is essential for refining your MVP and ensuring it meets user needs and expectations.

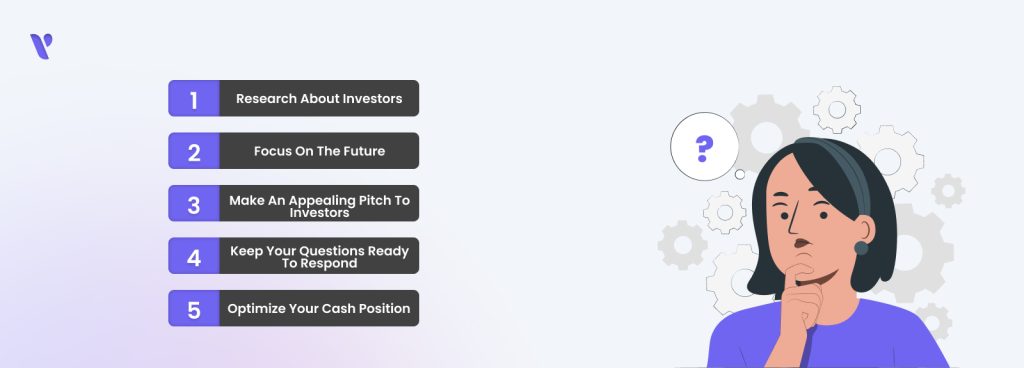

Once you’ve built an MVP, the next step is to find investors. Here’s how:

Conduct thorough research on potential investors to understand their objectives and past investments. This increases your chances of getting funding by targeting those with similar interests. Look for investors who have experience in your industry and have previously invested in MVPs.

When pitching to investors, emphasize your product’s future potential rather than its past. Demonstrate how your product can grow and succeed. Investors are interested in the scalability and long-term potential of your product.

Create a compelling pitch that highlights the key features of your product and the potential return on investment. Tailor your pitch to the interests of your potential investors. A well-crafted pitch can significantly increase your chances of securing funding.

For example, if your product is a food delivery service similar to Zomato, emphasize how popular online ordering and delivery are becoming. Stress the possibility of returning clients and their loyalty to companies that offer simple delivery choices.

This will help investors believe in your ability to successfully launch the product. A pitch that connects with potential MVP investors will improve your chances of securing funding for your mobile app.

When pitching a minimum viable product to potential investors, be ready to answer their many questions. This means being honest about the risks and challenges of your product.

If you’re pitching a new food delivery app, like one similar to Swiggy, be ready to answer questions about your competition, how you might lose customers, and how your business model can grow. Being open and honest about the risks will help you get MVP funding.

Ensure your cash position is strong before pitching to investors. Have a clear plan for how you’ll use the funds and demonstrate financial stability. A solid financial plan shows investors that you are serious about managing their investment responsibly.

Selecting the appropriate finance partner is essential to your startup’s success. Here are different types of funding partners you can consider:

Angel investors provide funds in exchange for equity or convertible debt. They offer valuable advice and industry experience but may require significant control or input.

Advantages

Disadvantages

Venture capitalists invest large amounts in startups with high growth potential. They provide substantial capital, industry connections, and advice but expect high growth and significant equity.

Advantages

Disadvantages

Crowdfunding allows you to raise small amounts of money from many people through platforms like Kickstarter or Indiegogo. It validates your market but requires a compelling pitch and time investment.

Advantages

Disadvanatges

Grants from government bodies, non-profits, or industry competitions can give you funding without asking for ownership in return. These funds are usually given based on how well your project stands out, its innovation, or its potential impact. Though it’s competitive, winning a grant or competition can boost the credibility of your MVP.

Advantages

Disadvantages

Corporate investors can provide funding, resources, and strategic partnerships. They offer industry-specific knowledge but may impose restrictions and competitive conditions.

Advantages

Disadvantages

Incubators and accelerators offer funding, guidance, and resources to early-stage startups. They provide comprehensive support but can be costly and require high commitment.

Advantages

Disadvantages

Funding from family and friends is quick and flexible but requires clear terms to avoid conflicts and limited industry expertise.

Advantages

Disadvantages

Debt financing means borrowing money that you’ll need to pay back with interest. It lets you keep full ownership of your startup, but you’ll need to make regular payments. Think about debt financing if you want to avoid giving up equity and have a solid plan for repayment.

Advantages

Disadvantages

Building an MVP is usually cheaper than developing a full app but can still be pricey depending on various factors. On average, an MVP costs between $1,000 and $5,000, considering the complexity, features, design, team location, and industry. Planning your budget carefully and considering all these factors will help you manage costs effectively. Reach out to our team and discuss your product idea with us today.

Building an MVP and securing funding in 2025 requires a clear plan, market understanding, and exploration of various funding options. Focus on essential features, test with real users, and prepare a compelling pitch to attract investors. With thoughtful planning and effort, you’ll be well on your way to turning your MVP into a successful business.

An MVP can attract investors, but it’s not always necessary. Sometimes, a good prototype is enough. However, for substantial funding, an MVP may be essential.

An MVP is a basic version of a product with key features for early testing and validation. It helps entrepreneurs prove their idea to investors and users.

Building an MVP typically takes 3-4 months, depending on complexity, industry, and team experience.

Common challenges include feature creep, ignoring user feedback, neglecting performance and scalability, and failing to validate assumptions. To avoid these, it’s important to define the scope of the MVP, collect and incorporate user feedback, build a strong foundation for growth, and validate assumptions.

An MVP is a functional, market-ready product with essential features to test its viability, while a prototype is a preliminary model used to test and explore different design options or technical feasibility. Prototypes are not usually released to the public, whereas MVPs are meant for real-world user testing.

YeasiTech is a trusted IT service partner with 8+ years of experience, empowering 250+ businesses with scalable web, mobile and AI solutions.

Explore related topics to broaden your understanding and gain actionable insights that can transform your strategies.