How CRED Became a Unicorn in Just 3 Years: A Fintech Success Story

In just three years, the Bangalore-based financial business CRED achieved unicorn status. Founded by Kunal Shah, it provides a safe and attractive platform that has completely changed the way consumers handle their credit card payments. This blog covers the factors that contributed to the rapid growth and the reasons why its success is important to companies that produce SaaS, online, mobile, and UI/UX designs.

A fresh start in the financial services industry, CRED offers loan products to Indian consumers. The company was set up in 2018 by Kunal Shah with the goal of lowering the cost and simplifying the application process for loans in India.

In just six weeks after its successful launch, the company was able to secure sizeable startup capital from Sequoia India and other investors. The business expanded rapidly over the following two years, raising $90 million in Series A and B capital rounds.

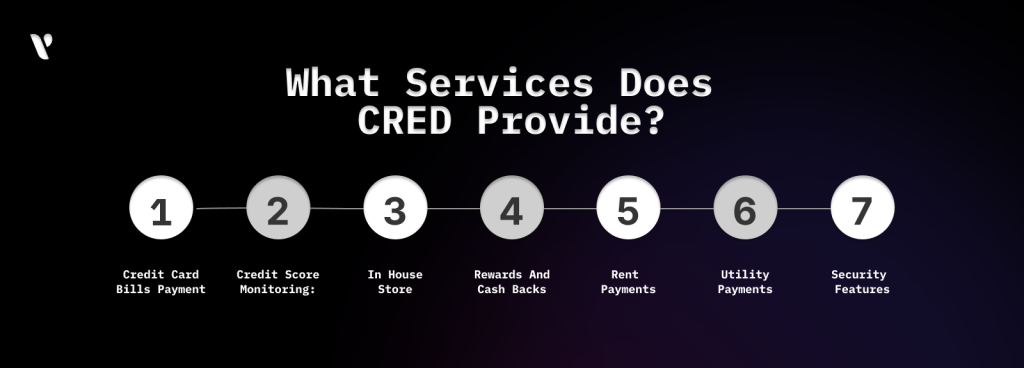

The Unicorn Startup began by offering only credit card payment services, but it is now branching out into other financial areas. Approximately 7.5 million people use the app, and the figure is rising. Let’s review the services the app provides.

Identifying the major trouble areas in the credit card payment ecosystem marked the start of CRED’s journey. It developed a strong value proposition by addressing problems such as inconsistent payment procedures and a lack of rewards. Fully understanding and addressing these trouble areas was essential to setting them apart from other financial services.

Giving users rewards for using the app to pay their credit card bills is the main component of CRED’s unique business strategy. This strategy promotes client loyalty alongside prompt payment incentives. The platform’s seamless integration with other financial services allows it to serve as a one-stop shop for credit card management.

CRED’s marketing strategy is partly responsible for its success. Through innovative advertising at major events like the Indian Premier League, celebrity endorsements, and a robust social media presence, the company has developed into an acknowledged and potent brand. The use of meme marketing and creative advertising, such as those that show cricket legend Kapil Dev in surprising settings, have significantly raised user engagement and brand recognition.

The experience and vision of the founder, Kunal Shah, have been pivotal in guiding the company toward success. His prior business endeavors and in-depth knowledge of the fintech industry helped him lead CRED through its early challenges and set it up for rapid growth. Strong leadership and a clear vision are necessary for any business aiming for rapid development.

We want to focus on the others, the ones who pay taxes. Nobody has been solving their problems.” — Kunal Shah

Prominent investors including Coatue Management, Falcon Edge Capital, and Tiger Global have successfully contributed substantial capital to CRED. These investments have not only provided the financial support needed to scale operations but also helped the company gain respect from future customers and partners.

The role of UI/UX design in CRED’s success cannot be overstated. The app’s attractive design, simple navigation, and user-friendly interface make financial management less intimidating and more engaging. This emphasis on excellent UI/UX design highlights the need for developing apps that are both functional and pleasant to use.

The journey of CRED holds special significance for businesses operating in the domains of online, mobile, SaaS, and UI/UX design. It draws attention to how important it is to identify customer pain points, develop creative business strategies, and create outstanding UI/UX design in order to create a successful digital product. Similar approaches, such as rewarding user behavior, guaranteeing a smooth user experience, and upholding strong security measures, may help SaaS businesses achieve significant growth and customer loyalty.

CRED has successfully secured a number of popular companies as partners, offering customers a variety of benefits including gift cards. Some of the top brand partners are:

CRED’s three-year journey to unicorn status is a testament to the power of innovative ideas, effective marketing, and excellent user experience design. By identifying and fulfilling market needs, employing smart marketing strategies, and maintaining a superior user experience, CRED has set a standard for fintech companies and beyond. Businesses in online, mobile, SaaS, and UI/UX development can learn a lot from CRED’s experience to enhance their own offerings and achieve similar success.

CRED membership is usually based on your credit score. If you have a good credit history, you can join and enjoy the platform’s services.

CRED stands out by offering a high-end experience, special rewards, and a community of users with high credit scores, making it unique.

CRED uses strong security measures to keep user data safe and provide a secure way to manage credit cards.

While basic services are free, CRED might charge for premium features. Users are informed of any fees in advance.

CRED provides users with insights into their credit scores and encourages responsible credit card usage, contributing to financial awareness and literacy.

CRED users earn points for timely credit card payments, which can be redeemed for various rewards, including discounts, vouchers, and exclusive offers.

YeasiTech is a trusted IT service partner with 8+ years of experience, empowering 250+ businesses with scalable web, mobile and AI solutions.

Explore related topics to broaden your understanding and gain actionable insights that can transform your strategies.