Top Features to Look for in Your Insurance Mobile App: 2025 Guide

Imagine a world where you can easily grab your favorite cup of coffee and manage your insurance policies right from home. Insurance Mobile App development is making this once-distant idea a reality. Insurance businesses are adopting mobile technology to improve client connections, promote development, and streamline operations in today’s energetic digital environment.

Why does this shift matter? Why should companies in the insurance industry focus on developing their mobile apps?

In this blog, we’ll explore the key features, benefits, different types, challenges, and more. We’ll break down what it takes to create an insurance mobile app that can revolutionize the market for both insurers and policyholders. Now let’s get started!

You may easily manage your policy using an insurance mobile app, which enables you to access data quickly, process claims, and make payments from anywhere at any time. With functions like customer service, document storage, and real-time notifications, these applications make life easier, enrich your experience, and guarantee that you can quickly access important insurance services.

New technologies have given entrepreneurs many chances to start businesses in different fields, including insurance app development. So, why create an insurance app? The global insurance market is predicted to grow to $8.4 trillion by 2026, with an annual growth rate of 9%.

The following are the top 6 reasons insurance providers have to think about developing a mobile app:

Automating routine processes using an app, such as processing claims, managing payments, and maintaining policies, minimizes errors and staff time. This reduces operating expenses and speeds up and improves the accuracy of everything.

An insurance app makes managing policies easier for clients. Users can file claims instantly, modify policies in real-time, and receive 24/7 assistance. This simplicity of use increases customer satisfaction and fosters loyalty.

An efficient and simple-to-use mobile app can help your company stand out in the crowded insurance market. A great app represents your dedication to offering innovative, customer-focused solutions and increases the reputation of your brand.

Mobile apps offer useful information about users’ preferences and behavior. Insurance providers may more effectively adjust their offers and marketing strategies by gaining insights into client trends and demands through data analysis.

With features like promotions and referrals, an app might be a powerful marketing tool that attracts new users. It increases the probability of profit by providing a platform for cross-selling and upselling insurance products.

For protecting sensitive user data, modern insurance mobile apps include multi-factor authentication and encryption, among other innovative security features. This emphasis on security promotes confidence and assures loyalty to industry rules.

The question of what is required to make a mobile insurance app viable may be on your mind. Don’t worry! Here’s a simple breakdown of the essential technology behind it:

This is where your customers will interact. It should be fast, user-friendly, and visually appealing.

Two ways to build your app:

Native Apps (Best performance)

Cross-Platform Apps (Faster & cheaper development)

This is where all the important things happen – policy management, claims, payments, and security.

The backend ensures:

Common backend technologies:

Think of this as a digital filing cabinet for all insurance-related information.

Best choices:

Your app needs a reliable home to run smoothly for users worldwide.

Best platforms:

These platforms provide security, speed, and storage so your app can handle thousands of users.

Since your app deals with money, security is the TOP priority!

Secure payment options:

Security measures:

Here are some examples of the several insurance app categories that are revolutionizing the market:

With life applications, customers can manage their policies by checking beneficiary information, payment schedules, and policy details. Through consistent provision of resources to assess coverage requirements, track policy performance, and obtain support, they assist clients in remaining informed and efficiently managing their life insurance policies.

These apps are for people who have insurance for cars, motorbikes, or other vehicles. They usually include features like roadside help, policy management, digital insurance proof, and tracking and managing claims. Some apps also help you find repair shops, estimate repair costs, and monitor your driving to promote safer driving.

Customers can view their health insurance details, past claims, and coverage information. Health insurance apps can improve the patient experience by offering digital ID cards, appointment scheduling, provider lists, and communication with health monitoring devices.

Entrepreneurs may handle various commercial insurance plans, such as property, workers’ compensation, and liability, with the use of business insurance mobile apps. With the help of these apps, customers may manage claims, evaluate risks, and handle insurance. They also offer tools to track coverage gaps, renew policies, and get expert help, all to better protect their assets and operations.

Property insurance apps are made to help you handle your home, rental, or other property insurance policies better. They give you a clear overview of your policy, tools to track and file claims, and features to list and record damage and inventory. These apps also offer useful tips for reducing risks, keeping up with property maintenance, and finding emergency contacts. With these features, property insurance apps make it easier and more efficient to protect and manage your property.

Travel insurance mobile apps help travelers manage their coverage easily. They should let you file claims, get emergency contact info, and check emergency details. These apps also offer extra features like tracking your trip, medical help, travel alerts, and quick support for lost luggage or canceled bookings, giving you peace of mind.

Read our article What’s the cost to build travel apps like MakeMyTrip and GoIbibo in 2025?

It’s important to consider the needs of admin and clients while developing an insurance mobile app. A good mobile app makes it easier for users to interact with and helps administrators manage things more smoothly.

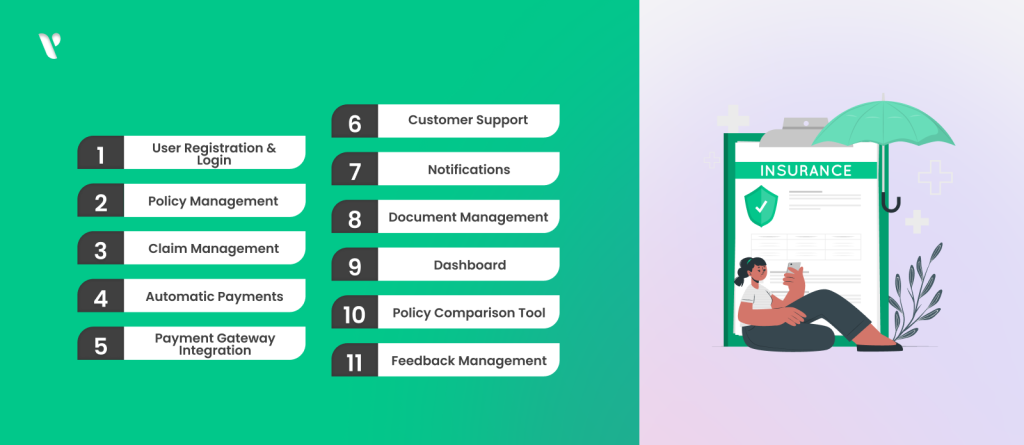

We’ve covered some of the key features that you may select for your insurance app both customer and admin panel below. Let us look into this in detail:

| Features | Admin Panel | Customer Panel |

| 1. User Registration & Login | This feature lets admin users add, view, and manage agent and customer profiles, including both personal and corporate details. | Here, customers can set up their profile and update their information, such as address, contact details, claims, and more. |

| 2. Policy Management | Admins can create, update, and manage insurance policies and coverage options. | Users can view, renew, and manage their insurance policies. |

| 3. Claim Management | Tools for reviewing, approving, and processing insurance claims. | User-friendly interface for submitting insurance claims that allows you to upload documents and monitor their status. |

| 4. Automatic Payments | Lets you set up commissions for brokers or agents, handle recurring billing for customers, and generate instant payment receipts. | It lets users pay their premium using various payment options. It also includes instructions for setting up automatic payments and reminders for upcoming payments. |

| 5. Payment Gateway Integration | Monitor transactions, manage payment gateways, and handle refunds | Secure payment options, including credit/debit cards and e-wallets |

| 6. Customer Support | User-friendly interface for submitting insurance claims that allow you to upload documents and monitor their status. | In-app chat, email support, and FAQs |

| 7. Notifications | Send bulk notifications, manage notification templates, and track engagement rates | Push notifications for policy updates, claim status changes, and promotional offers |

| 8. Document Management | Manage document storage, ensure compliance, and perform audits | Upload and view policy documents, claims documents, and payment receipts |

| 9. Dashboard | Admin dashboard with analytics, policy performance metrics, and user management | Customizable dashboard showing policy details, claim status, and payment history |

| 10. Policy Comparison Tool | Configure comparison parameters and manage policy data | Compare different insurance policies and coverage options |

| 11. Feedback Management | Collect and analyze customer feedback to improve services and resolve issues. | Rate and provide feedback on services and claims experience. |

You can get in touch with our team if you would like an insurance mobile app development idea estimate. Our team will assess your needs as a business and as a product before presenting an elaborate cost estimate.

The insurance industry is changing a lot right now. Insurance companies are now focusing on developing mobile apps to improve their operations and provide a better experience for their customers. These apps let businesses stay in touch with users and handle tasks from anywhere.

We hope this blog has given you a clear understanding. For a well-designed app, contact Yeasitech, a company that builds robust mobile apps with the latest technology. You can share your experiences or questions in the comments below.

The key features are a simple interface, secure login, complete policy management, smooth claims processing, payment options, personalization, integration with other services, customer support, analytics and reporting, and regular updates.

Multi-factor authentication makes security stronger by asking users to confirm their identity in several ways, like using a password, fingerprint, or a one-time code. This helps keep unauthorized people out and keeps your sensitive information safe.

An insurance app should let you pay in different ways, like with credit or debit cards, bank transfers, and digital wallets. It should also offer automatic payments and let you see your payment history to make managing your finances easier.

Personalization improves the user experience by letting users customize the app’s look, set their own notification preferences, and get recommendations that fit their needs. This makes the app more useful and easier to use.

Customer support should be available all day, every day through various methods like live chat, phone, and email. AI chatbots and a detailed help center can also help with common questions and problems.

Regular updates keep the app working well with the latest technology, fix any security issues, and add new features to keep up with changing user needs. This helps ensure a great user experience over time.

YeasiTech is a trusted IT service partner with 8+ years of experience, empowering 250+ businesses with scalable web, mobile and AI solutions.

Explore related topics to broaden your understanding and gain actionable insights that can transform your strategies.